I need to tell you something I don't usually admit publicly.

I bought 4 off-plan properties in Dubai.

Pre-launch. Two and a half years ago. Handover is coming up next month. And honestly? It's the biggest investing mistake I've made.

This is hard to write because I should have known better. My family has been in real estate for over 100 years. We've got warehouses, land holdings, commercial buildings across multiple countries. I grew up watching deals get made.

But Dubai has a way of making smart people do dumb things.

When I landed here, every agent I met wanted to show me renders. Beautiful towers. Payment plans. "Pre-launch pricing." I bought in. Four units.

Now I'm watching my secondary market properties generate 12% net annually while those off-plan units sit there, not producing a single dirham, waiting for handover.

Here's what I wish someone had told me before I wrote those checks:

The numbers nobody shows you

In 2018, researchers compared off-plan prices to ready property prices in the same locations.

Off-plan: 1,319 AED per square foot. Ready: 911 AED per square foot.

That's a 45% premium. For the privilege of buying something that doesn't exist yet.

You're paying 45% more to wait 2-4 years, take on construction risk, and hope the finished product matches the renders.

Why would anyone do this?

Follow the commission

Off-plan commission: 5-7% Secondary market commission: 2%

Some developers are offering 10% right now.

If you're an agent and an investor walks into your office, you have two choices:

Option A: Show them a brochure, take them to a nice sales center, collect 5-7%. Done by lunch.

Option B: Spend weeks putting in 200-500 offers to find undervalued properties, negotiate with motivated sellers, coordinate viewings. Collect 2%.

It's not a conspiracy. It's just math. Everyone in Dubai is selling what pays them.

What depreciation actually looks like

My friend bought a 3-bedroom in Damac Paramount for 4 million dirhams.

Current value: 2.8 million.

That's 1.2 million dirhams — over $300,000 USD — evaporated. From a major developer. In a prime location.

This isn't a one-off. Bayut published data showing:

Palm Jumeirah: down 16.6% year-over-year

Downtown Dubai (1-beds): down 9.1%

Discovery Gardens: down 15%

Business Bay: down 5%

These aren't bad areas. Palm Jumeirah is the most prestigious address in Dubai. And off-plan buyers there lost 16.6% in a single year.

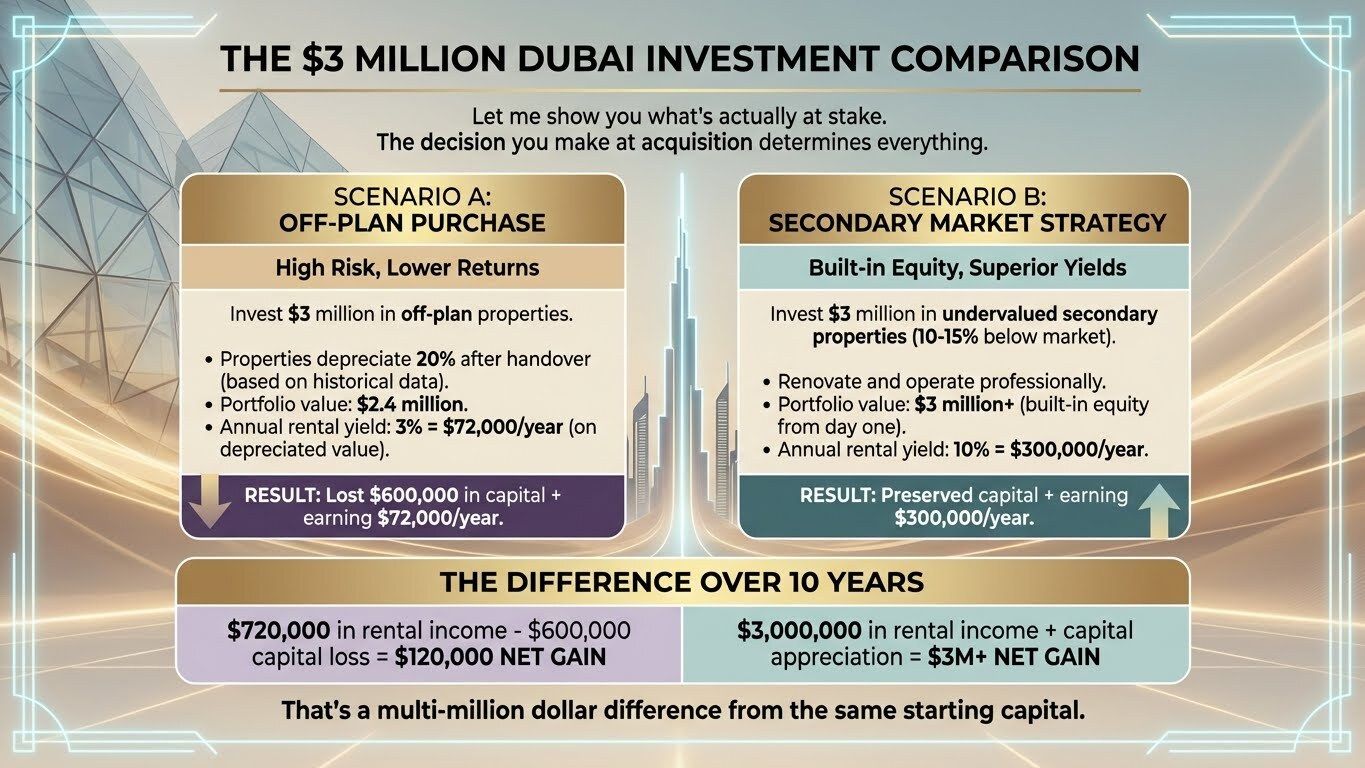

The real cost over 10 years

Let me show you what's actually at stake.

Path A: Off-plan

Invest $3 million

Wait 3 years (zero income)

Property depreciates 20% → now worth $2.4 million

Rental yield: 3% → $72,000/year

Path B: Secondary market (the way I buy now)

Invest $3 million in undervalued properties

Cash flow starts immediately

Property value maintained or appreciates

Rental yield: 10% → $300,000/year

The difference over 10 years: over $2 million.

Same starting capital. Completely different outcomes.

What I do now

Every property I buy follows the same playbook:

Prime areas only. JLT, Dubai Marina, Business Bay, Downtown. Places where demand is proven, not projected.

Older towers. 6-10 years old. The depreciation has already happened. Everyone chases new and shiny, so I get 20-30% discounts on the same locations.

Below market. I put in hundreds of offers looking for motivated sellers. Divorce, visa issues, estate sales, liquidity crunches. That's where the deals are.

Renovate properly. $20-25k turns a dated unit into the best apartment in the building. Guests don't care how old the tower is. They care about what's inside.

Blended rentals. Short-term during peak season (November-April). Monthly rentals in summer. Never annual leases.

The properties I bought this way? 12% net. The off-plan units sitting in limbo? Might sell them and redeploy the capital correctly.

Why I'm telling you this

Because I see the same pitch happening to investors every single day.

Someone flies into Dubai. Gets picked up in a nice car. Taken to a beautiful sales center. Shown renders and payment plans. Signs before they've done any research.

Then they spend years wondering why their "investment" isn't performing.

The data is public. The pattern is clear. But the incentives in this market are designed to push you toward off-plan regardless.

I made the mistake. I'm still dealing with it. Don't repeat it.

If you're serious about Dubai

I work with a small group of investors who want to do this correctly. Secondary market only. Undervalued acquisitions. Professional operations.

Not everyone qualifies — I'm not looking to scale this into some massive thing. But if you've got real capital to deploy and you want to avoid the traps I fell into, click the button below. We'll talk investor to investor.

Talk soon,

Arman

P.S. — If you bought off-plan and you're reading this feeling sick, I get it. Some of those properties can be salvaged with the right operational strategy. Some can't. Either way, knowing the truth is better than hoping the brochure was right.